By Jonathan Pless

Your Property Tax Bill May Be Affected by a Controversial Georgia House Bill.

Your property tax bill could soon see changes due to a controversial piece of legislation. House Bill 581 is making headlines once again as our county commissioners must decide whether to opt in or out by March 1st. But it’s not as simple as it may seem at first glance. Like most legislative documents, HB 581 is a complex, multifaceted bill with many moving parts. In fact, when asked for comment several weeks ago, Chairman Alan Gibbs admitted, “To be honest with you, even the state guys I’ve talked to don’t know all the ins and outs of this thing.” Here’s our best attempt to share what we know about HB 581.

What Are Property Taxes?

Before we dive into HB 581, let’s take a quick refresher on property taxes. Property taxes are an ad valorem tax, meaning “according to value.” Property is defined as land along with anything that is erected, growing, or affixed to it. Property is assessed at 40% of its fair market value. If taxes aren’t paid, the property can be levied and sold at a tax auction. The money collected through property taxes is used to fund services such as emergency services, public schools, landfill fees, and government employee salaries and benefits. Property assessments are conducted at the county level by the Board of Tax Assessors. The tax rate (or millage rate) is set annually by the board of county commissioners and the Board of Education.

A tax rate of one mill represents a tax liability of one dollar per $1,000 of assessed value. For example, the assessed value of a $100,000 home would be $40,000. In a county with a millage rate of 25 mills, the property tax on that home would be $1,000 ($25 for every $1,000 of assessed value, or $25 multiplied by 40, giving a total of $1,000 in property taxes due).

How Did House Bill 581 Come About and What Does It Mean for Me?

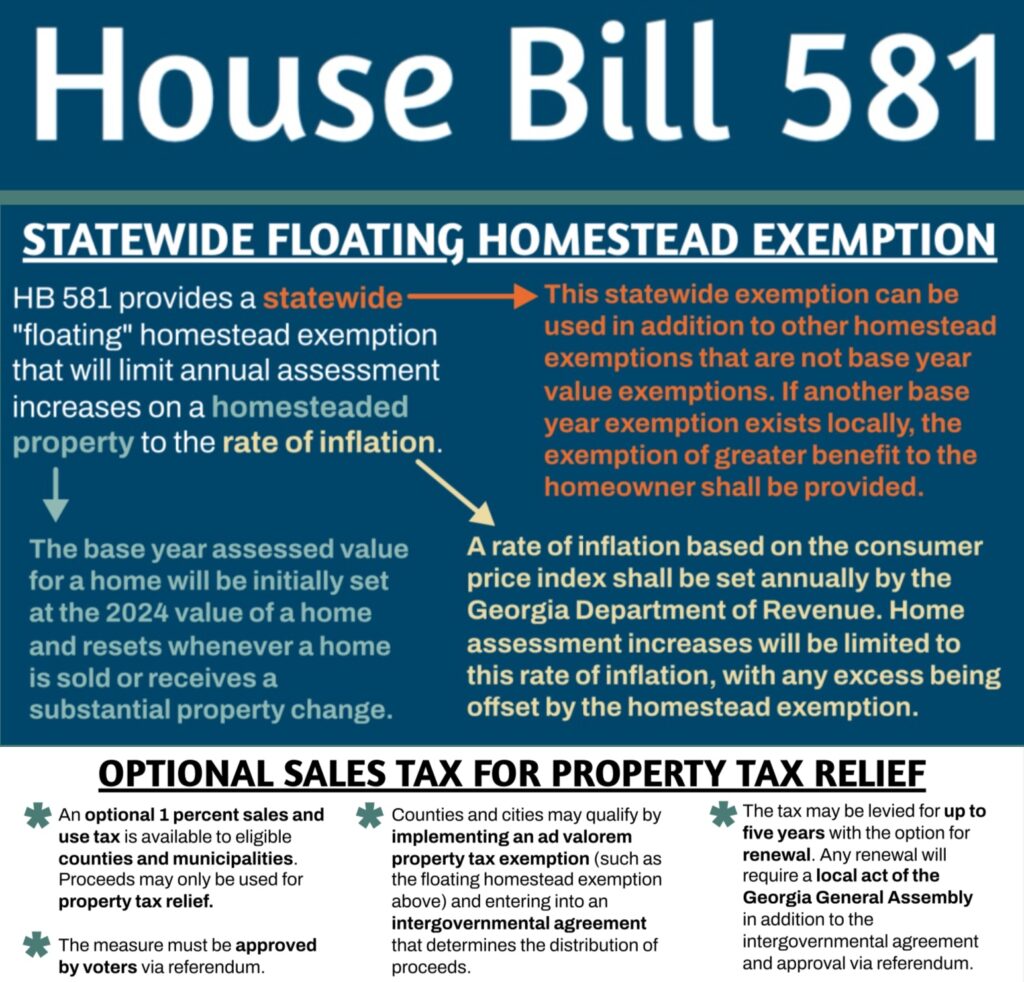

State lawmakers began developing HB 581 in 2023, with families and the elderly in mind. Many homeowners were struggling to keep up with skyrocketing home values and property taxes. So, the bill was drafted to limit property tax increases to no more than the yearly inflation rate. The goal was to slow the taxable value of properties by a more manageable rate of two or three percent (the inflation rate), as opposed to the astronomical five, six, or even ten percent increases that many were facing.

The bill passed the Georgia General Assembly in March 2024 and was signed into law by Governor Brian Kemp in April 2024. The law required a constitutional amendment, so it had to be ratified by voters. In November, the majority voted in favor of the bill, and it officially became law. It went into effect on January 1st, 2025.

Now, each individual county, city, and school board has two options: option one is to take no action and allow the amendment to take effect on March 1st, or option two is to opt out. Opting out requires a process of advertising and holding three public hearings. After the hearings, the county or city can officially choose to opt out of HB 581.

What Happens If Our Local Leaders Opt Out?

To understand the implications of opting out, we must break down the details of HB 581 further. The bill is divided into three parts:

Part A: New procedures for property tax assessments and appeals.

Part B: A new local homestead tax exemption.

Part C: A new floating local optional sales tax (FLOST) increase.

Part A applies by default, meaning no action is needed to implement it. It’s a technical part, and if you’re interested, you can visit the ACCG.org website for more information.

Part B is the heart of the bill and outlines how property values can only increase by the rate of inflation. However, two important factors should be noted: first, existing homestead exemptions will not change under this bill. Second, if you sell your home, the exemption doesn’t transfer to your new home. Furthermore, if you make improvements to your home, the full taxable value is reinstated, even if you’ve accumulated exemptions under HB 581 for years.

Part C introduces the Floating Local Option Sales Tax (FLOST), which allows cities and counties to levy a sales tax of up to 1% to offset property taxes. However, part C can only be enacted if both the county and city opt in to Part B. If both entities agree, they will negotiate an intergovernmental agreement (IGA) to decide how the sales tax revenue will be distributed. If an agreement isn’t reached, part C won’t go into effect.

Where Does Monroe County Stand?

The city of Forsyth has stated they’ll opt in to part B of HB 581. Meanwhile, the Monroe County School Board has officially opted out of part B. The county commissioners are still undecided, and they now face the difficult task of determining if part B aligns with Monroe County’s long-term goals. After researching, interviewing, and studying the bill, I can confidently say this is no simple decision. A bill that started as a way to help homeowners has become bogged down by complex legal language and if/then clauses.

If you don’t believe me, consider that state legislators recently introduced HB 92 as a corrective to HB 581. If passed, HB 92 would allow local officials to delay their decision until May instead of March. It seems that perhaps HB 581 was rushed into law before it was fully ready for prime time.

The third and final public hearing on this topic was held on February 13th, and unless HB 92 passes, the Board of Commissioners must make a decision by March 1st.

The Public Weighs In.

Monroe County constituents have not been shy about expressing their opinions. At the February 4th hearing, Russ Edge addressed the commissioners, commenting on Monroe County’s unique position. He noted that with new industries arriving and Georgia Power’s presence in the area, tax revenue will likely increase, making additional taxes unnecessary.

Another comment from Jennifer Mize echoed a common sentiment: “This was voted on. The commissioners should respect the vote. It should not be a debate.”

Pros and Cons of HB 581

Like all legislation, HB 581 has both advantages and drawbacks. Some potential benefits of the bill include:

It rewards long-term homeowners with reduced property taxes.

It attempts to regulate sharp increases in taxable home values.

It shifts the tax burden from homeowners to other property owners (commercial, agricultural, industrial, and non-homestead residential).

However, there are also some drawbacks:

There are no immediate tax breaks for struggling individuals.

There is a disproportionate tax burden placed on some property owners in the future.

The long-term effects are unknown.

The decision to opt in or out is permanent, with no opportunity for a future change.

There are still several unexplored factors that even state legislators haven’t fully considered.

What Does This Mean for You?

For most taxpayers, HB 581 won’t result in significant changes. In order for you to benefit from part B of the bill, you’d have to meet very specific criteria: own a home this year, stay in your home for a decade or more, never sell or improve your home, and only then will part B affect 40% of your total property tax bill.

Considering these conditions, you might save more money by budgeting wisely rather than depending on HB 581.

The Bottom Line

I encourage all Monroe County residents to take the time to study this bill in full. Whether or not our commissioners opt in, it will have an impact on us all. Our commissioners are open to questions and have been very helpful throughout this process. Don’t hesitate to contact them with any clarifying questions, or share your opinions. As with all elected officials, they work for us, and I believe they want to make the best decision for our county.

I’m confident that, no matter the decision, we can continue to work together for the good of Monroe County. Monroe Matters.